House of representatives has passed the infrastructure investment and jobs act (iija) , better known as the bipartisan infrastructure bill. The senate passed the bill in.

Free Electrical Estimating Spreadsheet Check More At Httpeasybusinessposterscomfree-elec Electrical Estimating Estimate Template Resume Template Examples

House of representatives has passed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill.

Infrastructure investment and jobs act tax provisions. There are relatively few tax provisions in the infrastructure legislation, but more extensive changes may be coming in a fiscal year 2022 budget reconciliation bill that remains under consideration by. Here’s what you need to know. For those items whose effective date is tied to the date of enactment,.

The bill was then presented to president. “it’s really a great time to be us,” said jim guarino, a managing director at top 100 firm baker newman noyes. House of representatives has passed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill.

These provisions can be grouped. The infrastructure investment and jobs act, first passed by the us senate in august, has now been passed by the us house of representatives on november 5, 2021 with an estimated cost of $1.2 trillion. Almost three months after it passed the u.s.

Almost three months after it passed the u.s. 3684, the “infrastructure investment and jobs act.” the vote was 228 to 206. On november 5, the house passed the bipartisan infrastructure investment and jobs act, h.r.

While the bulk of the law is directed. Senate passed the same version of the bill on august 10, 2021 on a bipartisan basis. For each provision the effective date of the provision is noted.

House of representatives passed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill. 3684, the “infrastructure investment and jobs act,” (the “infrastructure act”). Almost three months after it passed the u.s.

The act provides for more than $550 billion in new infrastructure spending. Thus, congressional action of this bill has been completed. Tax provisions in the infrastructure investment and jobs act.

While the bulk of the law is directed. Although most of the tax provisions are expected to be included in the pending h.r. The american rescue plan act (arpa) had extended the credit to eligible employers for the third and fourth quarters of 2021.

Although not primarily a tax bill, the infrastructure investment and jobs act (iija) does contain some provisions that have a tax impact. On november 15 in a bipartisan ceremony, president biden signed into law h.r. The bbba could, for example, have significant provisions regarding the child tax credit, the cap on the state and local tax deduction, and limits on the business interest expense deduction.

Wolters kluwer tax & accounting looks at the tax provisions of the infrastructure investment and jobs act. President biden signed the bill into law on november 15. President biden signs infrastructure investment and jobs act into law:

House of representatives has passed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill. We’ll keep you current on the developments that could affect both your personal and business’s bottom lines. Facebook page opens in new window twitter page opens in new window linkedin page opens in new window.

On monday, president biden signed hr 3684, the infrastructure investment and jobs act, into law. The infrastructure act reverses, in part, the 2017 tax cuts and jobs act’s amendment to i.r.c. The president has indicated that he hopes to sign.

The infrastructure investment and jobs act, passed by the senate earlier in august, will affect taxes in ways that are not yet decided or fully comprehended — and that has many taxpayers reaching out to their advisors. The infrastructure investment and jobs act (iija) includes a massive investment in infrastructure projects, with a handful of tax provisions tucked inside. Included in the new law are a few tax provisions of note to taxpayers.

The act is being sent to the president who is expected to sign the bill. While the bulk of the law is directed toward massive investment in infrastructure projects across the country, a handful of noteworthy tax provisions are tucked Almost three months after it passed the u.s.

House of representatives has passed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill. Senate, president biden has signed the infrastructure investment and jobs act (iija), better known as the bipartisan infrastructure bill. House of representatives tonight passed h.r.

Us Investment Since The Tax Cuts And Jobs Act Of 2017 In Imf Working Papers Volume 2019 Issue 120 2019

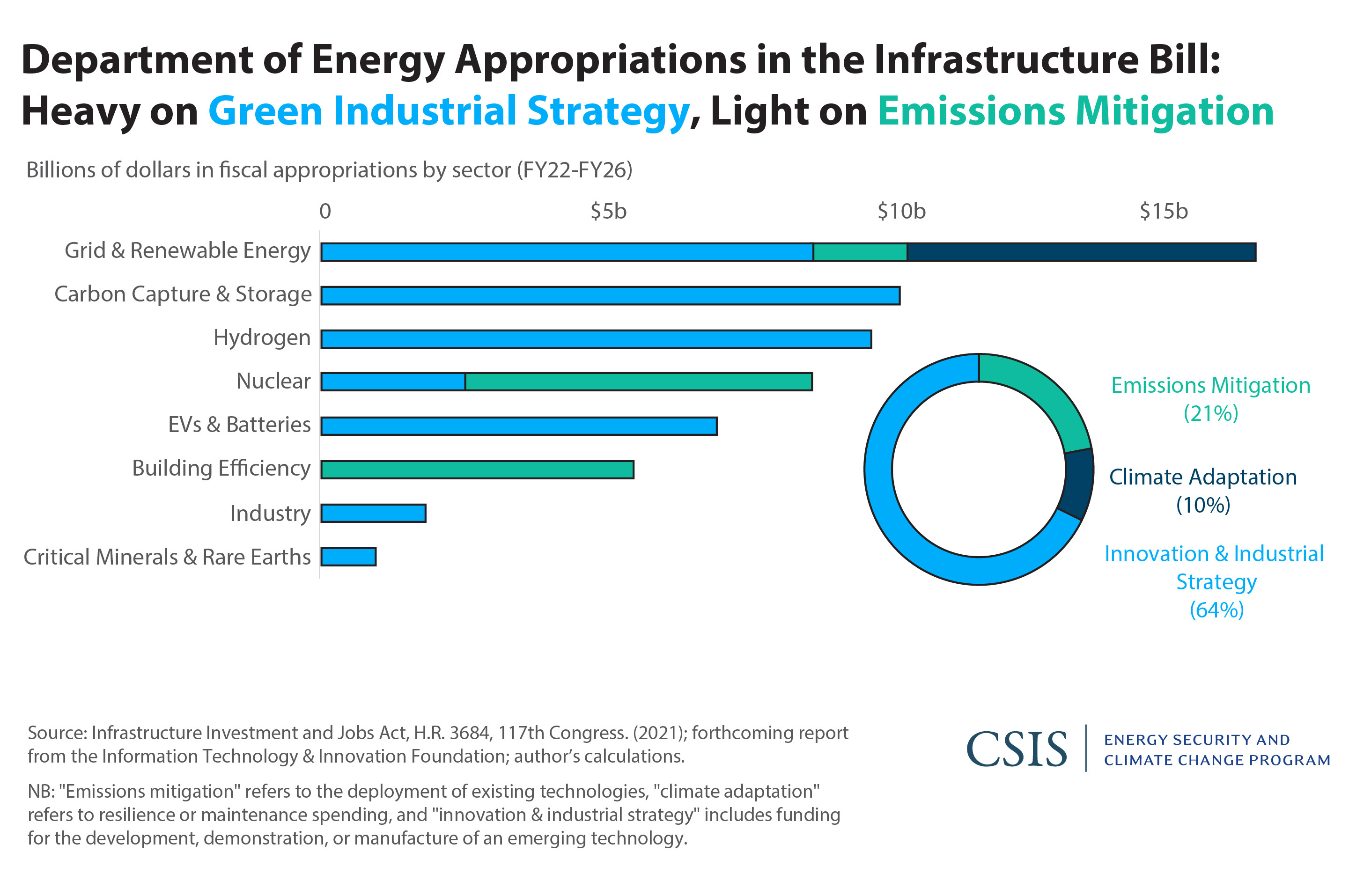

The Infrastructure Investment And Jobs Act Will Do More To Reach 2050 Climate Targets Than Those Of 2030 Center For Strategic And International Studies

Myths And Facts Infrastructure Investment Jobs Act

Myths And Facts Infrastructure Investment Jobs Act

Infrastructure Investment And Jobs Act Signed Into Law Dentons - Jdsupra

Western New England University School Of Law Offers Many Ways To Earn A Law Degree In Addition To Our Three-year Full-time Pr New England University Western New England Business Professional Attire

Chain Reaction Rocktrees Omer Ozden And Kevin Obrien Chinas Mammoth Blockchain Market Opportunity Bitcoin Cryptocurrency Blockchain

Ncri Recruitment 20202021 Form Portal Apply Here At Wwwncrigovcom Recruitment How To Apply National Examination

Us Investment Since The Tax Cuts And Jobs Act Of 2017 In Imf Working Papers Volume 2019 Issue 120 2019

Us Investment Since The Tax Cuts And Jobs Act Of 2017 In Imf Working Papers Volume 2019 Issue 120 2019

Indonesias New Investment List Increases Fdi Opportunities For Foreign Investors Indonesia Notes

Free Electrical Estimating Spreadsheet Check More At Httpeasybusinessposterscomfree-elec Electrical Estimating Estimate Template Resume Template Examples

Infrastructure Investment And Jobs Act - Wikipedia

Indonesias New Investment List Increases Fdi Opportunities For Foreign Investors Indonesia Notes

Us Investment Since The Tax Cuts And Jobs Act Of 2017 In Imf Working Papers Volume 2019 Issue 120 2019

Bank Instrument And Money Related Establishments Likewise Consolidate Their Services And Monetary Items For Helped B Banking Services Bank Instrument Investing

Us Investment Since The Tax Cuts And Jobs Act Of 2017 In Imf Working Papers Volume 2019 Issue 120 2019

What The Infrastructure Investment Jobs Act Could Mean For Infrastructure Investors Global X Etfs

Infrastructure Investment And Jobs Act Ey - Us